Note that these rates are. Continuing the scenario from the Module 2 discussion think about the costs to manufacture your product.

Pin On Flevy Business Best Practices

The definition of activity-based costing is a management accounting approach to the costing and monitoring of activities which involves identifying the activities the bring about specific costs.

. The activity-based costing process. Cost driver rate which is calculated by total cost divided by total no. The ABC method can also change the unit cost of low-volume products by transferring overhead costs from high-volume products.

Properly assigning indirect costs is extremely important for management especially in the case of downsizing or outsourcing. Activity-Based Costing ABC is a method of allocating costs to products and services. The goal of activity-based costing is to assign specific resources to objects.

Absorption Variable and Activity Based Costing By the due date assigned respond to the following in the Discussion Area below. What is Activity Based Costing ABC. In other words the costing of products or services is based on activities performed to manufacturerender a particular product or.

Activity based costing helps allocate overhead expenses to jobs and products based on the amount of the activities required to produce the product instead of simply estimating how much each job uses. Activity-based costing is a costing methodology that assigns costs to activities and then assigns the cost of each activity to the products or services that are generated by that activity. Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities.

It is a costing system that focuses on activities performed to make goods. Activity-based costing ABC is a costing approach in which the company will first identify the activities it undertakes and then determine the resources consumed by each activity. Activity-Based Costing ABC is a method of allocating costs to products and services.

Review the concepts of activity based costing. It is calculated by taking the cost pool total and dividing it by the cost driver. It increases understanding of overheads and cost drivers.

The system can be employed for the targeted reduction of overhead costs. What benefits does ABC provide. It was developed as an approach to address problems associated with traditional cost management systems that tend to have the inability to accurately determine actual production and service costs or.

ABC is based on the principle that products consume activities. Activity-based costing is a costing method that focuses on activities performed to produce products. Activity-based costing is known as ABC costing.

The difference between activity-based. This is unique as it focuses on activities. It is a process of tracking resource use and pricing final outputs.

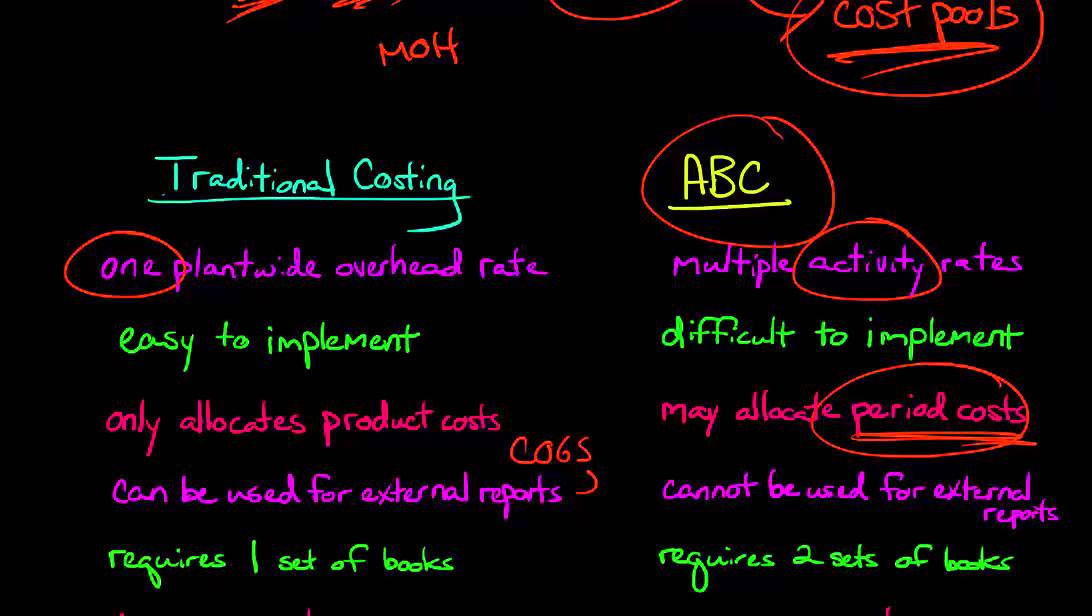

Traditional cost systems allocate costs based on direct labor material cost revenue or other simplistic methods. ABC is a more accurate way to assign costs to products and services than traditional methods like job-based or overhead allocation. This costing system is based on the premise that activities are responsible for the incurrence of costs and create the demands for resources.

Activity-based costing provides a more accurate method of productservice costing leading to more accurate pricing decisions. Each activity its cost and related activity driver are identified below. It is that costing method in which costs are first attributed to activities and then to products.

The Ascent goes through how activity-based costing works. Activity-based costing is a process of calculating the cost of products that accounts for indirect costs. It is generally used as a tool for planning and control.

Activity Based Costing ABC is a 2 step method of costing whereby costs are first allocated to identified activities of a business and then from activities they are assigned to products or services. Ad Browse Discover Thousands of Business Investing Book Titles for Less. It specifically identifies the activities that cause production costs to increase helping.

Of activities to arrive at a profit. Activity based Costing ABC is a systematic cause effect method of assigning the cost of activities to products services customers or any cost object. Activity-based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

Activity-based costing is a concept that serves as a basis for an economic model. Activity-based costing traces previously untraceable costs such as depreciation to particular activities. The ABC system of cost accounting is based on activities which are considered.

Activity-based costing ABC is a method to determine the total cost of manufacturing a product including overhead. Activity Activity Cost Activity Driver Material handling RM225000 Number of parts Number of parts Material insertion RM2475000 Automated machinery RM840000. It is generally used as a tool for planning and control.

Activity-based costing is a method used to track the actual cost of producing a product. The ABC method allocates direct and indirect costs to goods and services. In addition to helping track overhead costs an ABC system allows better understanding of activity and facility costs insight into profitability.

Under this method the products cost is based on the actual resources consumed and the effort actually made. Activity-based costing ABC is a method of assigning overhead and indirect costssuch as salaries and utilitiesto products and services. HiTech Sdn Bhd uses an activity-based product costing system.

If youre on a Galaxy Fold consider unfolding your phone or viewing it in full screen to best optimize your experience. It was developed as an approach to address problems associated with traditional cost management systems that tend to have the inability to accurately determine actual production and service costs or. And makes costly and non-value adding activities more visible allowing managers to reduce or.

The company has identified five activities. This methodology is used in accounting because it is products that consume activities unlike traditional. This model assigns more indirect costs overhead into direct costs compared to conventional costing.

It assigns costs to various activities and not to services or products. This methodology is more popularly adhered to in manufacturing industries. Activity based costing also known as ABC costing refers to the allocation of cost charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie.

This device is too small. Activity-based costing ABC is a costing method that assigns overhead and indirect costs to related products and servicesHowever some indirect costs such as management and office staff salaries are difficult to assign to a product. Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities.

Activity Base Costing Abc Details Knowledge Of What Is Activity Based Costing

Cost Management Plan Example Templates Cost Accounting Abc Activities Key Performance Indicators

Unit 5 Activity Based Costing Study Objectives Recognize The Difference Between Traditional Costing And Act Cost Accounting Powerpoint Presentation Education

Activity Based Costing Beratung

Activity Based Costing Abc In Excel Sales Techniques Sales Training Marketing Analysis

General Activity Based Costing Explanation Video Managerial Accounting What Activities Activities

Abc Costing Cost Accounting Managerial Accounting Activities

Pin On Flevy Marketplace For Premium Business Documents

3d Activity Based Costing Donut Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Process Diagrams Powerpoint Charts Diagram Diagram Chart

4 2 Activity Based Costing Method Managerial Accounting Managerial Accounting Revision Guides Activities

Infographic Activity Based Costing Ca Student Blog Education Icas Activities Infographic Education

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Accounting Cost Accounting Presentation Deck

Cost Hierarchy Meaning Levels And Example Accounting And Finance Accounting Education Economics Lessons

Activity Based Costing Activities Cost Accounting Accounting Principles Pool Activities

Activity Based Costing Abc Cost Accounting Accounting And Finance Financial Management

Activity Based Costing Arrow Diagram Http Www Poweredtemplate Com Powerpoint Diagrams Charts Ppt Business Models D Diagram Chart Powerpoint Charts Powerpoint

Activity Based Costing Accounting Principles Accounting And Finance Financial Strategies